Lukrom iFund LP

A Private Credit Fund Secured by Real Estate Exclusively for Accredited Investors

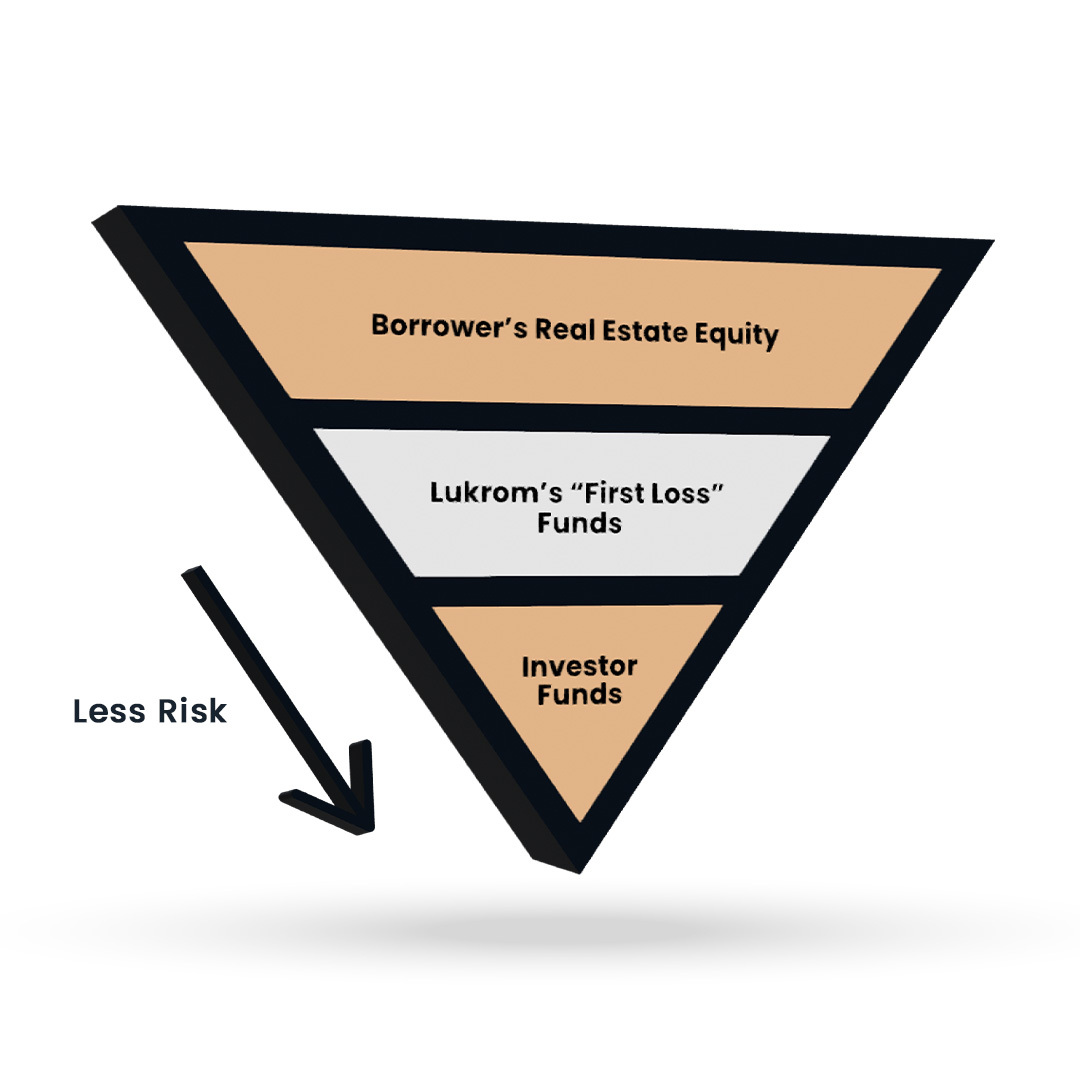

When we say we put our investors first, we mean it. $15M of Lukrom iFund is invested by our Executive Team and Advisory Board in a “First Loss” position.

Although we don’t anticipate any losses, this First Loss Commitment will absorb any potential losses that extend beyond the real estate equity of the borrowers. NO OTHER FUND IS DOING THIS!

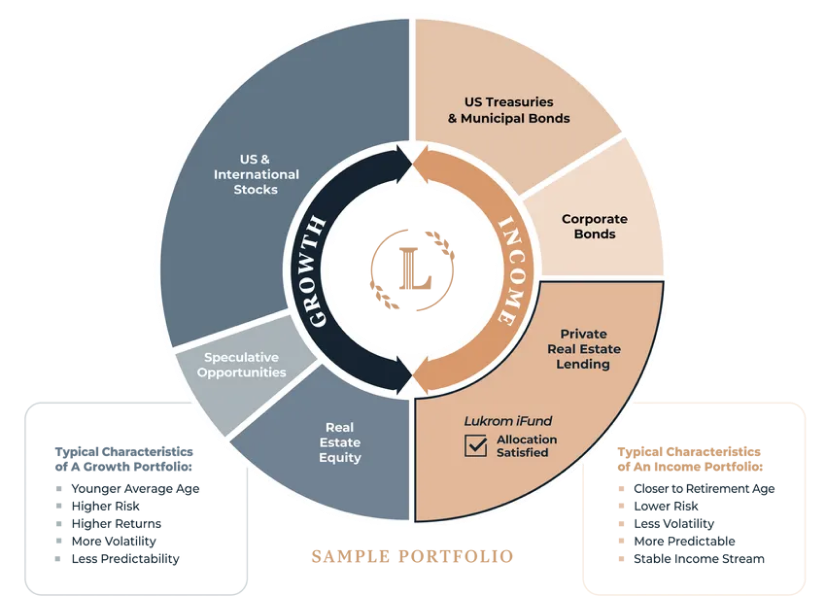

The 60/40 Stock/Bond Portfolio is broken. Both Stock and Bond Markets were down over 20% in 2022. Our investors enjoyed a 7-10% gain. That’s about a 30% swing! This sample portfolio shows a smart approach to diversification beyond stocks and bonds. Lukrom iFund is a great alternative investment that can be used for reliable income or growing net worth.

A Private Credit Fund Secured by Real Estate Exclusively for Accredited Investors

IMPORTANT MESSAGE: Lukrom.com is a website owned and operated by Lukrom LLC (“Lukrom”). By accessing the website and any pages thereof, you agree to be bound by the Terms of Service, Privacy Policy and Disclosures, as each may be amended from time to time. Lukrom is not a registered broker, dealer, investment advisor, investment manager or registered funding portal. Prospective investors are advised to carefully review the Lukrom’s private placement memorandum, operating agreement and/or partnership agreement, and subscription documents (“Offering Documents”) and to consult their legal, financial and tax advisors prior to considering any investment in the Lukrom, one of its subsidiaries or affiliates. Sales of any securities will only be completed through the Company’s Offering Documents and will on be made available to “Accredited Investors” as defined by the Securities and Exchange Commission (“SEC”). Generally, an Accredited Investor is a natural person with a net worth of over $1 million (exclusive of residence) or income in excess of $200,000 individually or $300,000 jointly with a spouse. The securities are offered in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended, and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. Neither the SEC nor any state regulator has reviewed the merits of or given its approval to the securities, the terms of the offerings, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities. All forward-looking statements address matters that involve risks and uncertainties and investors should be able to bear the loss of their entire investment. All investors should make their own determination of whether or not to make any investment, based on their own independent evaluation and analysis. Past performance is not indicative of future returns or Fund results. Individual investment performance, examples provided and/or case studies are not indicative of overall returns of the Company. In addition, there can be no guarantee of deal flow in the future. Forward looking statements are not statements of historical fact and reflect the Company’s views and assumptions regarding future events and performance.